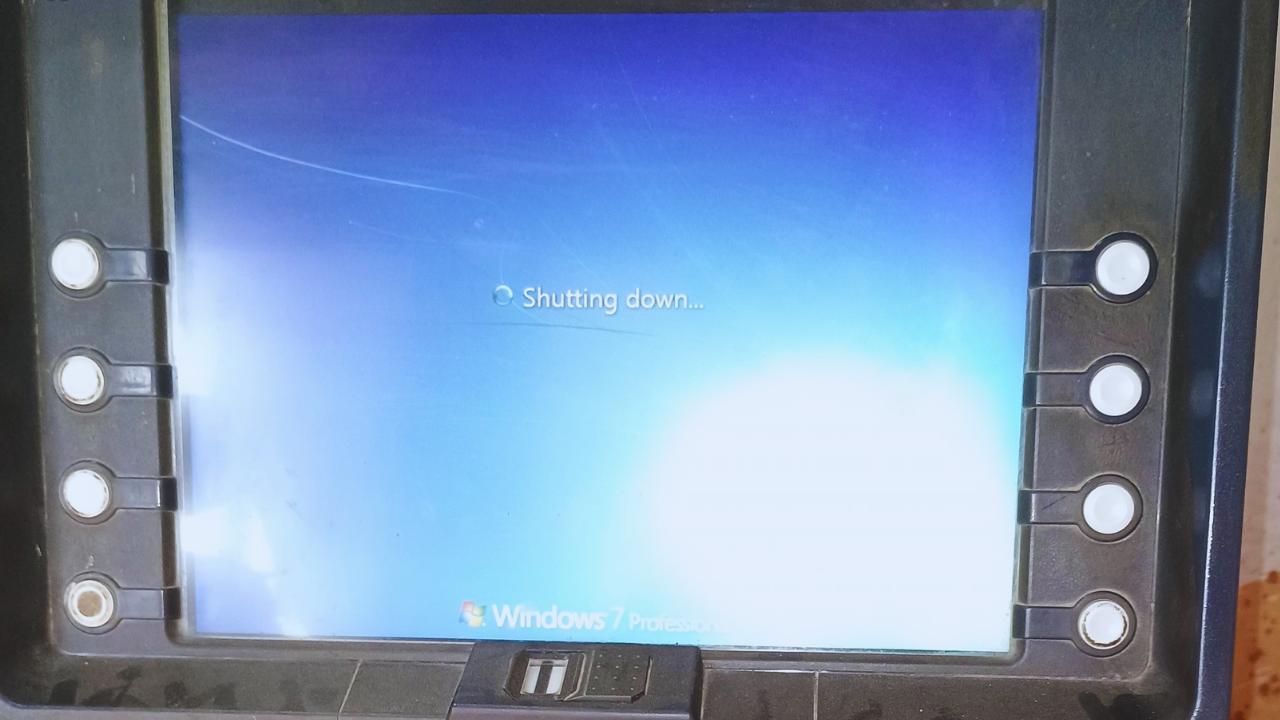

How to Deal With Mid-Transaction Shutdowns at ATMs Amid Unsuccessful Cash Withdrawals; Expert Answers All (image source: X/ @JaikyYadav16 )

Recently, a social media user, Jaikay Yadav (@JaikyYadav16), shared an unfortunate incident where an ATM malfunctioned mid-withdrawal, resulting in the deduction of funds from their bank account without cash being dispensed. ” I withdrew money from the ATM but the ATM shut down midway. Money was deducted from my account but no money was withdrawn from the ATM. I have an account with Indian Bank. People should tell us after knowing what should be done?” X user wrote. (translated from Hindi)

Such incidents, while concerning, is not uncommon and can leave users feeling anxious and uncertain about their next steps

In response to such situations, experts provide valuable insights to guide individuals through the process. Aditya PS, Founder & Chairman of Terraeagle Technologies, offers practical advice to navigate this critical scenario.

Step 1: Gather Essential Information

The first step entails collecting essential details pertaining to the incident. Note down the ATM ID, time of occurrence, and the location where the card was retained and funds were debited.

“The ATM ID, akin to an asset ID, is typically located on the top or side of the ATM. Additionally, record the ATM’s location and the name of the bank operating the ATM,” said Aditya PS.

Step 2: Contact the Bank

If the ATM belongs to the same bank where your account is held, promptly inform the bank’s customer care or visit the nearest branch. Lodge a complaint regarding the incident and request either the retrieval of your card or the issuance of a new one. In cases involving ATMs of the same bank, the debited amount is typically reversed within 24 hours.

Step 3: Dealing with Different Bank-Issued Cards

For cards issued by a different bank, once the ATM operator retrieves the card, they will send it to the nearest branch of your bank within 5-7 days. However, it’s advisable to lodge a complaint with your bank’s customer care and apply for a new card. This proactive step ensures the expedited resolution of the issue.

Step 4: Seeking Further Assistance

Should the bank fail to resolve the matter within the stipulated timeframe, you have the option to escalate the issue to the banking ombudsman. Contact details for the ombudsman are typically available on the bank’s website. Seeking their intervention can facilitate a swift resolution and provide recourse in case of prolonged delays.

Encountering situations where an ATM deducts funds without dispensing cash can be unnerving, but knowing the appropriate course of action can mitigate stress and facilitate a resolution.