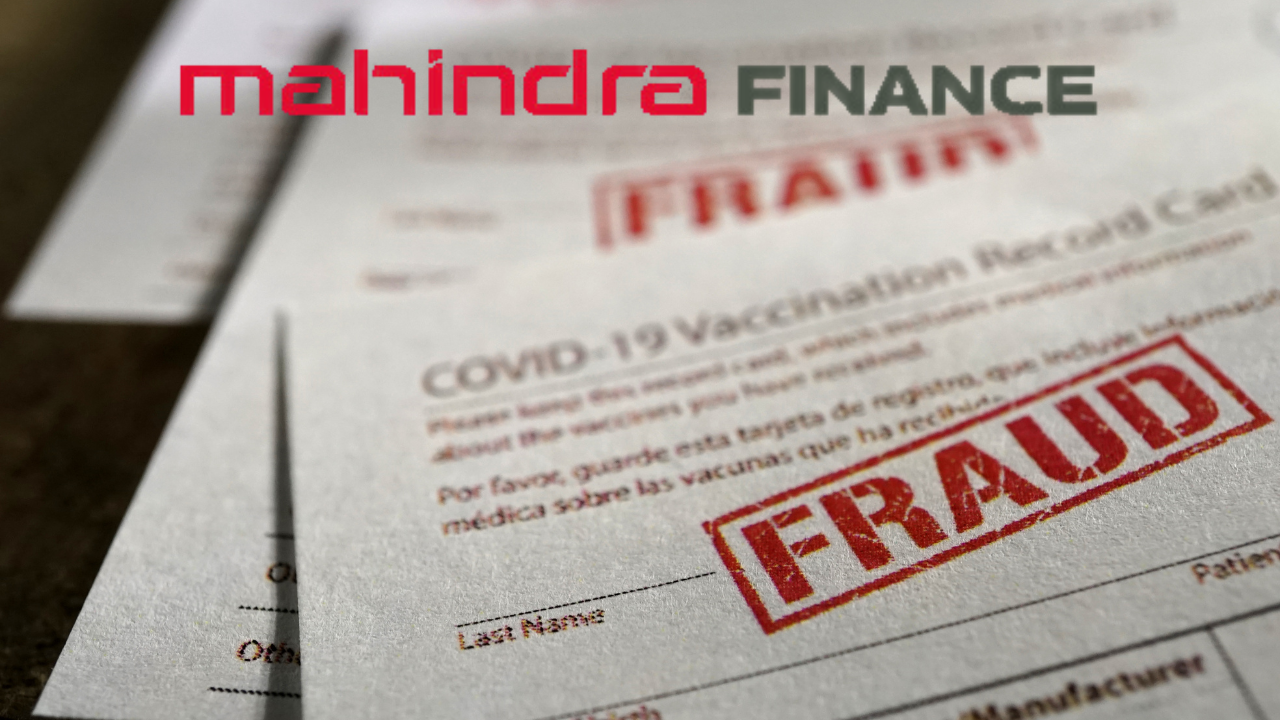

Rs 1,500,000,000 Fraud At A North East Branch, Mahindra And Mahindra Financial Services Shares Plunge 8 pc (image source: Canva)

Mahindra And Mahindra Financial Services Share Price: The stock market was rattled on Tuesday as Mahindra & Mahindra Financial Services saw its share price plummet by over 7 per cent in early trading. The steep decline came in the wake of a startling revelation: the company had uncovered a fraud amounting to Rs 150 crore at one of its branches in the North East region. As investors grappled with the implications of the fraud, Mahindra Finance shares tumbled by as much as 7.88 per cent to Rs 256.85 apiece on the Bombay Stock Exchange (BSE).

Board Meeting Deferred: Uncovering the Fraud

In a move to address the unfolding crisis, Mahindra & Mahindra Financial Services announced the postponement of its scheduled board meeting, originally slated for April 23. The meeting, which was intended to review the financial results for the quarter ended March 2024, will now convene at a later date, to be communicated in due course. The decision to defer the meeting came in light of the alarming discovery of fraudulent activities at one of the company’s branches in the North East.

Forgery and Embezzlement

In a disclosure to the stock exchanges, Mahindra Finance revealed the nature of the fraud that had been unearthed. According to the regulatory filing, the fraudulent scheme involved the forgery of Know Your Customer (KYC) documents, which were then used to siphon off company funds in the guise of retail vehicle loans disbursed by the company. The estimated financial impact of the fraud stands at a staggering ₹150 crore. The company emphasized that investigations into the matter are progressing, with corrective measures already underway. Several individuals implicated in the fraud have been apprehended, marking a significant step in addressing the issue.

Implications and Deferrals: Repercussions on Financial Reporting

Given the gravity of the situation, Mahindra & Mahindra Financial Services opted to defer key agenda items originally slated for discussion at the board meeting. Matters pertaining to the approval of audited standalone and consolidated financial results for the fourth quarter and financial year ended March 31, 2024, as well as the recommendation of dividends, Annual General Meeting (AGM) proceedings, and related issues, will be deferred to a later date. The company assured stakeholders that the Audit Committee and Board Meeting scheduled for April 23, 2024, would proceed as planned to address other agenda items, including proposals to increase aggregate borrowing limits and raise funds through the issuance of Non-convertible debentures.